More than seven million households in England and Wales will be impacted by the Bank of England’s hike in interest rates.

The Bank of England has increased the base rate of interest to 5% today in a move that will bring mortgage misery to millions. It’s the 13th time in a row that rates have been increased as the BoE tries to curb inflation.

On Wednesday the news broke that inflation stayed at 8.7% for the second month in a row, despite efforts to bring it down.

READ MORE: Bank of England interest rate rise to 5% and what it means for you and your mortgage

But the relentless rate rises are set to push many homeowners to the brink, with household finances already stretched by the cost of living crisis. There are almost 7.4m households in England and Wales where the owner occupier has a mortgage, according to figures from the 2021 Census.

That works out at just under 30% of all households in the country. Another 33% of households are owned outright by the people who live there, while another 17% are social housing, and 20% private rental accommodation.

The data doesn’t make clear how many of those private rent households are where the landlord has a mortgage, and the number of homes with a mortgage varies by neighbourhood.

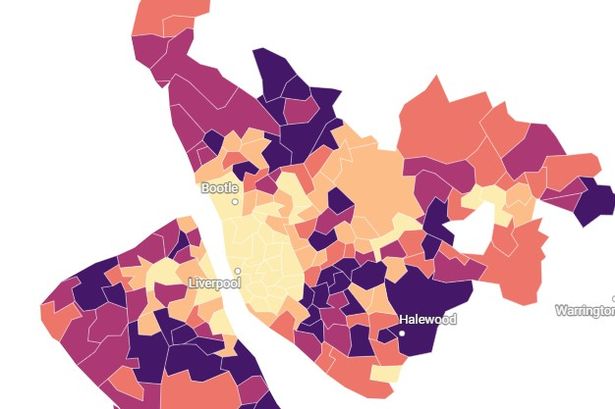

Merseyside areas vary from having anywhere between 7% to 44% of households with a mortgage in place. You can take a look at the map above to see how your area fares.

If you can't view the map within the article, you can open it here

Receive newsletters with the latest news, sport and what's on updates from the Liverpool ECHO by signing up here